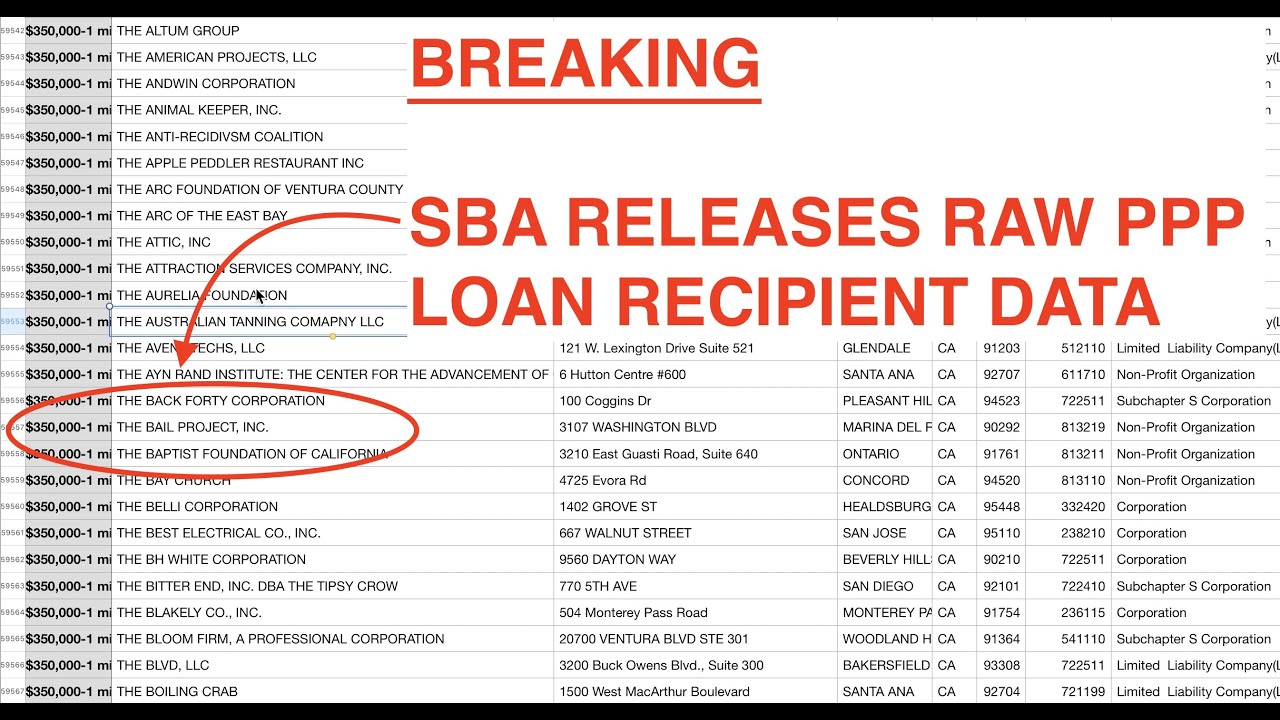

A list of recipients of the Paycheck Protection Program (PPP) loans is a compilation of businesses and individuals who received funding under the program. This list details the names associated with each loan application and approval, offering insights into the scope and reach of the program. This data can be a valuable resource for various purposes, from tracking the program's impact on different industries to performing research on loan terms and recipient characteristics.

Access to this list of names can be critical for understanding the economic effects of the PPP. Analyzing the characteristics of recipients, such as business type or location, can reveal trends and patterns associated with loan uptake and utilization. The list's availability can also facilitate research into the effectiveness of the program in achieving its intended goals, which often include sustaining employment and preventing business closures. Historical analysis of these lists can reveal long-term effects and inform future policy decisions related to small business funding.

This data, however, is subject to certain limitations and considerations. Privacy regulations often apply, limiting the accessibility and usability of the complete dataset. Further, interpreting the data requires caution to avoid drawing misleading conclusions about specific businesses or the program's overall impact. Specific details concerning the loan applications, including loan amounts and forgiveness outcomes, are not directly reflected in a list of names alone. This article will explore these and other associated data points, context, and considerations further.

PPP Loan List of Names

Understanding the Paycheck Protection Program (PPP) loan recipients, as detailed in a list of names, is crucial for evaluating the program's success and its impact on the economy. This list offers essential data about the businesses and individuals who accessed these crucial funds.

- Recipient identification

- Loan amounts

- Business types

- Geographic distribution

- Loan forgiveness status

- Program compliance

Analyzing recipient names, along with loan amounts and business types, provides insights into the program's effectiveness. Geographic distribution highlights regional impacts, while loan forgiveness status reveals program adherence. A look at compliance helps determine if the program was used appropriately. Examples might include identifying clusters of restaurants in specific regions receiving large loans or observing the loan forgiveness rates for a particular industry. This comprehensive information is vital for assessing the program's overall impact and for future policy decisions. A high proportion of small businesses obtaining funds, but a low rate of forgiveness, might signal an issue requiring further analysis.

1. Recipient Identification

Recipient identification, as a core component of a PPP loan list of names, is essential for understanding the program's reach and impact. The ability to pinpoint specific businesses and individuals who received loans facilitates analysis of loan distribution patterns, program effectiveness, and potential areas for improvement.

- Accurate Business Information:

Precise identification of businesses is critical for accurately assessing the program's impact on various sectors. Identifying the specific type of business (e.g., retail, restaurant, manufacturing) allows for targeted analysis of the program's effect on different industries. This enables policymakers and researchers to understand the economic recovery strategies adopted by various enterprises, potentially highlighting the program's success or shortcomings in certain sectors. For example, an analysis might reveal whether businesses in the hospitality industry received disproportionately more loans than those in the manufacturing sector. This, in turn, might indicate which industries the program successfully supported during the economic downturn.

- Geographic Distribution:

Identifying the geographic location of loan recipients provides insights into regional variations in loan application rates and loan forgiveness outcomes. Analysis can reveal whether certain regions experienced a higher or lower uptake of the program. Examining regional disparities might expose geographical challenges or opportunities within the programs distribution model, potentially informing future PPP iterations.

- Loan Amount Correlation:

Linking recipient identification to loan amounts reveals patterns in loan usage. Understanding the correlation between business type, size, or geographic location and the amount of loan received can highlight the program's capacity to support diverse business needs. Statistical analysis can show if smaller businesses in disadvantaged areas received fewer or larger loans, relative to their counterparts. Such correlations provide a crucial benchmark for assessing program equity and effectiveness across different recipient groups.

- Compliance Tracking:

The ability to identify PPP loan recipients allows for monitoring compliance with program guidelines and requirements. By linking loan recipients to their respective employment data or loan usage patterns, compliance officers and researchers can identify potential inconsistencies or irregularities. If, for example, a significant number of recipients in a particular industry demonstrate noncompliance, it could signal systemic issues requiring further investigation, and inform future program design.

In summary, precise recipient identification within a PPP loan list of names is fundamental for a nuanced understanding of the programs reach, effectiveness, and impact. It allows for the examination of various variables, enabling a more comprehensive analysis of the program's economic implications and the efficacy of its design. Data analysis can then inform future policy decisions aimed at enhancing economic recovery initiatives.

2. Loan Amounts

Loan amounts represent a crucial component within a PPP loan recipient list. The inclusion of loan amounts alongside recipient names provides critical data for evaluating the program's impact and identifying trends. This allows for a detailed examination of how funds were distributed, and to what degree the program met its goals. Understanding the correlation between loan amounts and other variables, such as business type or location, is essential for a comprehensive evaluation.

Consider a hypothetical analysis. If a list reveals that a significant number of restaurants in a particular city received comparatively low PPP loans, it could signal disparities in funding availability or access. Conversely, if a specific industry sector consistently receives substantial loan amounts, this could indicate a concentrated effort by the program to bolster that industry's recovery. Examining these patterns provides insight into the program's allocation strategies and their perceived effectiveness in different economic sectors. Analysis can determine if the funding was targeted appropriately, or if disparities exist in funding availability between different regions or business types.

The practical significance of understanding loan amounts within the context of a PPP recipient list is substantial. It enables policymakers to evaluate the program's effectiveness in achieving its economic recovery objectives. By identifying potential inequities or inefficiencies in loan distribution, they can inform policy adjustments or provide insights into future program design. Researchers can use this data to determine the loan amount's correlation with business survival, employment retention, and economic recovery in specific regions. Understanding the varying loan amounts allocated to different businesses provides valuable insights into the program's strengths and weaknesses.

3. Business Types

Categorizing businesses based on type, as detailed in a PPP loan recipient list, is crucial for analyzing the program's impact. The distribution of loans across various sectors provides insights into the program's effectiveness and potential areas for improvement. Examining loan recipients by industry reveals trends, allowing policymakers and researchers to understand how different sectors were affected by the program.

- Retail Sector Analysis:

Analyzing the retail sector's representation among loan recipients reveals the program's impact on brick-and-mortar stores and e-commerce businesses. High loan uptake among retail businesses might suggest the sector's vulnerability to economic downturns, while low uptake might imply robust financial resilience. This data can illuminate the program's ability to sustain employment and economic activity in the retail sector. Understanding the specific retail sub-sectors receiving loans (e.g., clothing, electronics, specialty stores) can unveil finer-grained responses to the economic downturn.

- Restaurant and Hospitality Impact:

The restaurant and hospitality sector's representation in the loan list reveals the program's assistance to this vital but often vulnerable sector. High loan usage in this sector might demonstrate the program's success in mitigating job losses and business closures. Variations in loan amounts could highlight the need for targeted support for specific restaurant types or locations. Comparing this sector's experience to others can reveal patterns in business recovery following the economic shock.

- Manufacturing and Production Trends:

The manufacturing and production sector's position within the loan list provides insight into the program's impact on essential industries. Loan uptake and amounts can demonstrate the extent to which the program supported critical production sectors during economic disruptions. Analyzing this sector's performance relative to others can show whether the program effectively prioritized industries with a direct impact on the national economy. Identifying the types of manufacturing businesses receiving funds might uncover specific industry needs or resilience factors.

- Small Business Diversity:

Disaggregating the list to show small business diversity across sectors reveals the breadth of the program's influence. The program's impact on small businesses within various industries, particularly those with fewer resources, highlights its capacity to support varied economic landscapes. Examining loan amounts, forgiveness rates, and loan usage patterns within different categories of small businesses provides valuable data for program evaluation and future initiatives.

By categorizing businesses in a PPP loan recipient list by type, one can identify patterns of support and the potential needs of different sectors. This information is fundamental to assessing the program's effectiveness and crafting targeted support in future economic crises. Comparing the performance of different business types, considering loan amounts and loan forgiveness rates, reveals the program's strengths and weaknesses regarding targeted support for various economic sectors. This analysis helps assess which sectors the program most effectively sustained during economic downturns.

4. Geographic Distribution

Analyzing geographic distribution within a PPP loan recipient list of names is essential for understanding the program's regional impact. This analysis reveals patterns of loan uptake and utilization across different areas, offering insights into the program's efficacy in stimulating economic recovery at a localized level. Disparities or concentrations in loan applications can highlight specific regional needs or challenges in accessing financial support.

- Regional Variations in Loan Applications:

Examining loan applications across different regions reveals variations in loan uptake. A concentrated area of applications might suggest a higher need for support within a specific geographical area. Conversely, a sparse distribution could indicate different needs or access issues to the program in other regions, potentially due to economic conditions, limited awareness or differing business structures within that area. For example, a cluster of applications for retail businesses in a particular metropolitan area might point to specific economic conditions or recovery needs affecting that area.

- Concentration of Loans in Specific Industries:

Within a region, certain industries might demonstrate a significant concentration of loan applications. This could indicate an industry's vulnerability in that geographical area, requiring targeted support. For instance, a high concentration of loans within the restaurant industry in a coastal region might reveal a sector needing particular assistance, potentially due to economic conditions unique to that area. Identifying such concentrations provides valuable information about program efficacy and potential shortcomings.

- Correlation with Economic Indicators:

Analyzing the geographic distribution of loan amounts alongside economic indicators (e.g., unemployment rates, business closures) allows for a deeper correlation. Areas with high loan concentrations and high unemployment rates might signify the program's success in mitigating economic hardship within that region. Conversely, a lack of correlation might suggest issues with program accessibility or effectiveness in certain areas.

- Identifying Gaps in Program Accessibility:

Examining the geographic distribution of loan applications might reveal areas with limited access to the program. This information could guide strategies to enhance program awareness and accessibility within underserved regions. For instance, a region showing minimal PPP loan applications compared to other areas might indicate a need for targeted outreach and education efforts to encourage participation in the program.

In conclusion, analyzing geographic distribution in a PPP loan recipient list provides valuable insights into the regional impact of the program. By identifying regional variations in loan applications and relating them to economic indicators, the program's effectiveness and potential weaknesses can be better understood. This understanding aids in developing targeted strategies for future economic recovery initiatives.

5. Loan forgiveness status

Loan forgiveness status is a critical element within a PPP loan recipient list. The ability to link loan recipients to their forgiveness status provides crucial data for evaluating the program's effectiveness and identifying potential issues. It allows for a deeper understanding of how the program impacted businesses and their long-term viability. Analysis of forgiveness rates and patterns associated with various business types, locations, or loan amounts can illuminate specific factors related to the program's success.

- Analysis of Forgiveness Rates:

Determining the overall forgiveness rate for PPP loans provides a general measure of the program's success. High forgiveness rates may suggest the program was effective in supporting businesses, while low rates could indicate challenges with eligibility requirements, loan use restrictions, or documentation hurdles. Comparative analysis across different industries or geographic regions reveals whether certain sectors or areas experienced more or less success in loan forgiveness.

- Identifying Patterns in Forgiveness Denials:

Analyzing the reasons for loan forgiveness denials, where available, is important for identifying potential problems with the program. If a specific type of business or location consistently faces denials, it may signal a need for program adjustments or clarification regarding eligibility criteria. Understanding the reasons for denial helps in targeting future programs and enhancing their accessibility and effectiveness. For example, consistent issues regarding proper documentation in a specific industry might necessitate targeted assistance and clarification.

- Correlation with Loan Amounts:

Examining the correlation between loan amounts and forgiveness status can highlight the program's impact on different business sizes. Are smaller loans consistently forgiven at a lower rate compared to larger ones? If so, it might signal a problem in supporting smaller businesses. The analysis can help identify whether the program's structure is suitable for different scales of business operations. Such insights are vital for refining the program's architecture and allocation strategy for future iterations.

- Evaluation of Sector-Specific Performance:

Analyzing forgiveness rates within specific industries reveals the program's impact on different sectors. For example, high forgiveness rates within the manufacturing sector might point to the program's effectiveness in that area, while low forgiveness rates in a particular sector might signal a problem related to the sector's needs, economic circumstances, or compliance with the program's guidelines.

In conclusion, linking loan recipients to their forgiveness status offers a critical perspective on the program's impact. By scrutinizing forgiveness rates, denial patterns, and correlations with other variables, a deeper understanding of the program's successes, challenges, and implications for future policy can be gained. This data is paramount in ensuring the equitable and effective distribution of financial assistance in future economic crises.

6. Program Compliance

Program compliance, as a critical aspect of the Paycheck Protection Program (PPP), is intrinsically linked to the PPP loan recipient list. The list of names provides a foundation for evaluating whether the program's guidelines and regulations were followed. Maintaining compliance ensures the program's integrity and effectiveness in achieving its economic recovery objectives. Analysis of compliance within the context of the recipient list is crucial for identifying potential misuse of funds and establishing accountability.

- Verification of Loan Use:

A key element in program compliance is verifying that loans were used as intended, primarily for payroll, rent, and utilities. Analysis of the recipient list allows for the examination of loan amounts against the documented use of funds. Deviation from intended use patterns may indicate potential misuse or misappropriation of funds. This would require an examination of the loan details, supporting documentation submitted by the recipient, and employment records in specific cases.

- Assessment of Employment Retention:

Compliance often includes evaluating whether the program effectively maintained employment. Cross-referencing the recipient list with employment records and subsequent workforce data allows for this evaluation. A significant drop in employment after receiving a PPP loan, unrelated to legitimate business circumstances, might signal non-compliance. This can be evaluated using payroll information, employee headcount reports, and associated industry data, to establish a baseline.

- Identification of Potential Fraud:

Analyzing the recipient list, combined with compliance data, helps identify potential fraudulent activities. Unusual patterns in loan applications, amounts, or use may indicate attempts at program abuse. Tracking the loan application process, loan disbursement procedures, and final loan forgiveness status, and identifying inconsistencies can be vital in identifying fraud. Investigating anomalies through detailed audits and tracing the path of funds would be crucial.

- Evaluation of Reporting Accuracy:

Compliance necessitates accurate reporting. Examining the consistency between the data reported on the recipient list and the actual use of funds ensures the accuracy of data and adherence to reporting requirements. Differences between reported expenditures and confirmed records warrant an investigation into possible inaccuracies or inconsistencies. A comparison of reported expenditures to the final loan forgiveness status, and associated supporting documentation, is important.

In summary, the PPP loan recipient list acts as a crucial foundation for evaluating program compliance. By examining the recipient data, tracking loan usage, and looking for anomalies or inconsistencies, a more comprehensive evaluation of the program's performance and its potential areas for improvement can be made. This information is vital in ensuring the long-term integrity of the program and responsible allocation of taxpayer funds. Ultimately, maintaining strict compliance is critical to the PPP's effectiveness and broader economic recovery efforts. A robust evaluation of the recipient list helps in ensuring accountability and the effective use of public funds.

Frequently Asked Questions about PPP Loan Recipient Lists

This section addresses common inquiries regarding lists of Paycheck Protection Program (PPP) loan recipients. These questions provide clarification on the purpose, accessibility, and implications of this data.

Question 1: What is the purpose of a PPP loan recipient list?

A list of PPP loan recipients provides a compilation of businesses and individuals that received funding under the program. This data can be used for various research and analytical purposes, including evaluating the program's reach, impact on different industries, and regional economic effects. It also enables researchers to track trends and assess program compliance.

Question 2: Is the complete list of PPP loan recipients publicly available?

Public access to a complete, unredacted list of PPP loan recipients is not universally available. Data privacy regulations and the need to protect sensitive information often limit public access to these datasets. Limited data, specific subsets, or aggregated figures may be accessible under certain conditions and through specific channels. Checking with the relevant government agencies or organizations that manage this data is essential.

Question 3: How can I use this data if it's not completely public?

Accessing limited or aggregated data allows for specific research inquiries. Researchers can analyze trends across different sectors or regions. Aggregate data, such as loan amounts by industry, might be available, allowing for sector-specific analyses without revealing individual recipient information.

Question 4: What are the limitations of using this data?

Interpreting data from a PPP loan recipient list requires careful consideration. Privacy concerns and potential biases in the dataset must be acknowledged. Drawing conclusions about individual business performance based solely on loan receipt should be avoided. Instead, broader trends and patterns observed across larger datasets should inform interpretations. Data must be analyzed cautiously.

Question 5: How can I find relevant information on the program?

Official government websites and resources dedicated to the PPP often provide access to aggregated data, summary reports, or publications that examine the program's broader impact. Consultation with experts in economic analysis and financial research can provide added context to the data interpretation.

Question 6: What ethical considerations should I keep in mind when using this data?

Maintaining data privacy and confidentiality is paramount. Data should only be used for legitimate research and analytical purposes, respecting the privacy of individuals and businesses featured in the list. Caution must be taken to avoid misrepresentation or misinterpretation of findings. Respecting data privacy through ethical data handling and analysis is a critical consideration.

Understanding the specifics of data access and availability, as well as potential limitations and ethical considerations, is vital for anyone seeking to utilize data related to PPP loan recipients. Responsible data utilization ensures that conclusions drawn from the data are accurate, well-informed, and respectful of confidentiality.

This concludes the FAQ section. The following section will delve deeper into specific details surrounding the economic impact of the PPP.

Tips for Utilizing PPP Loan Recipient Data

Effective utilization of Paycheck Protection Program (PPP) loan recipient lists demands careful consideration of various factors. Data analysis requires a nuanced approach to derive meaningful insights, avoid misinterpretations, and ensure responsible handling of sensitive information. This section offers practical guidance for researchers, analysts, and policymakers seeking to leverage this data.

Tip 1: Prioritize Data Aggregation and Analysis over Individual-Level Detail. Focusing on aggregate datasuch as loan amounts by industry or geographic regionoffers broader insights into the program's impact without revealing sensitive individual information. This aggregated approach enables understanding of overarching patterns and trends, avoiding potential privacy violations and data breaches.

Tip 2: Employ Robust Statistical Techniques for Correlation Analysis. Correlating loan uptake with economic indicators, such as employment rates or business closures, demands rigorous statistical methods. Avoid anecdotal observations or superficial correlations. Sophisticated statistical analysis can identify meaningful relationships and provide evidence-based conclusions rather than relying on subjective interpretation.

Tip 3: Scrutinize Potential Biases in the Dataset. PPP recipient lists might reflect inherent biases in loan application rates or access based on factors like location, industry, or business size. Researchers must acknowledge and address potential biases in their analysis to avoid drawing inaccurate conclusions about the program's impact on specific groups. Methods of controlling for these biases, such as statistical modeling, should be employed.

Tip 4: Prioritize Data Accuracy and Validation. Ensuring data accuracy and consistency is crucial. Employ validation checks to eliminate inconsistencies and errors in the data. Incorrect or incomplete data can lead to flawed analysis and misinterpretations of the program's impact. Verification through cross-referencing with other reliable data sources is recommended.

Tip 5: Adhere to Data Privacy Regulations and Ethical Considerations. Any analysis involving PPP loan recipient data must adhere to all relevant data privacy regulations and ethical standards. Anonymization and secure handling of sensitive information are paramount to prevent breaches and protect the privacy of individuals and businesses. Protecting sensitive business information is vital. Any release of data should be done according to strict guidelines.

Tip 6: Contextualize Findings with Broader Economic Trends. Interpreting data within the framework of broader economic trends and conditions is essential for drawing accurate conclusions. The analysis must account for pre-existing economic conditions, external factors impacting businesses, and the overall economic recovery in relation to the PPP's role in stimulating business activity. This broadens the perspective.

By following these guidelines, analysts and policymakers can leverage PPP loan recipient data effectively, drawing meaningful insights into program impact without violating ethical norms or producing misleading results. This leads to more responsible and accurate interpretations of economic trends, enhancing the value of the PPP recipient data for future economic policy.

The next section will explore the multifaceted role of the PPP in the economic recovery.

Conclusion

Analysis of Paycheck Protection Program (PPP) loan recipient lists reveals crucial insights into the program's economic impact. Recipient identification, loan amounts, business types, geographic distribution, loan forgiveness status, and program compliance all contribute to a comprehensive understanding. Examining these factors across various sectors and regions provides valuable data for evaluating program success, identifying potential areas for improvement, and assessing the overall economic recovery. The data illuminates trends in loan uptake, distribution patterns, and the correlation between loan amounts and subsequent business performance, fostering a more nuanced understanding of the program's efficacy in mitigating economic hardship.

While the data offers significant potential for informed policy decisions and future economic planning, responsible data handling remains paramount. Preserving confidentiality and avoiding misinterpretations are vital. Utilizing robust statistical methods and acknowledging potential biases are crucial for accurate analysis. Further research and analysis, incorporating these considerations, can lead to a more refined understanding of the PPP's enduring economic impact, helping to inform future policy design and resource allocation in economic downturns.

You Might Also Like

Maddy Smith's Husband: Everything You Need To KnowIs Bear Grylls Dead? Latest News & Updates

Adam Mayfield: NFL Star's Journey & Highlights

Discover Hang Mioku Now!

Unblocked Retro Games: Classic Arcade Fun!

Article Recommendations

- Katt Williams Kids Adopted

- Kaitlyn Dever Partner

- Movierulz Telugu 2024 Download

- T Y Hilton

- Adelia Clooney

- Bivol Religion

- Nathan West

- Pj Fleck First Wife

- Hernlen

- Antonio Cupo